Iowans deserve a tax system that works for all of us. Unfortunately, many Iowans believe the current system is rigged against them. The proposed tax changes Governor Reynolds floated in her Condition of the State Address are a good example of why.

The Governor’s plan is a tax shift that will have a big impact on the pocketbooks of Iowa families. Three in four Iowans likely will see a tax increase. Low-income Iowans and those on a fixed income will be hardest hit.

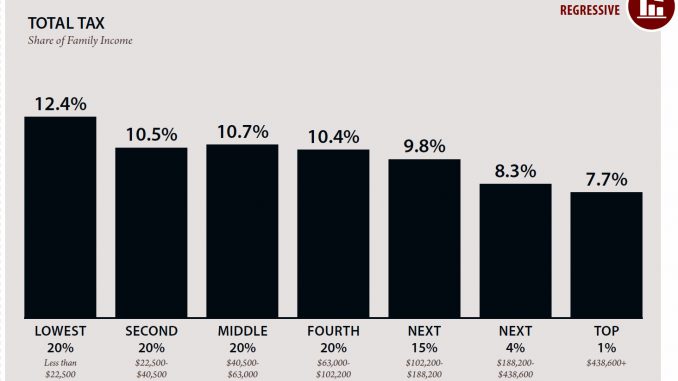

Iowa’s current tax system already places a higher burden on lower-income Iowans than on the wealthiest. The Governor’s proposal makes the situation worse.

Senate Democrats will assess any tax bill on four key principles:

- Tax

reform must be fair. According to the Iowa Policy Project, when all

state and local taxes are accounted for, Iowa’s lowest income earners pay the

largest portion of their income in taxes. Changes to Iowa’s tax system should

address this situation, not make the problem worse.

- Tax

reform must simplify Iowa’s tax code to highlight our state’s true

competitiveness. Iowa’s tax code is a confusing collection of credits,

deductions and exemptions that do not accurately reflect the cost of living and

doing business in Iowa. Our tax rates appear to be among the highest in the

nation, but according to the Tax Foundation, taxes paid by Iowans rank our

state in the middle of the pack.

- Tax

reform must fit our budget situation. Iowa, under Republican control, has

not approved enough funding for state government to meet the needs of Iowans. Let’s

not repeat the mistakes of states such as Kansas, which passed massive tax cuts

that have resulted in an ongoing budget crisis and cuts to essential services.

Tax reform must examine corporate tax credits. Under Republican control, the state has slashed funding for vital programs that serve some of our most vulnerable Iowans, while corporate tax credits have been exempt from cuts. We must determine if corporate tax credits offer a good return on investment and benefit Iowans, not just the few businesses that receive them.