SF 2383 – Senate Republican tax plan

FLOOR & COMMITTEE ACTION:

SF 2383, a Senate Republican tax bill, makes major changes to Iowa’s tax system that will reduce taxes by more than $1 billion annually. These reductions come from changes to what income is subject to tax for individuals and corporations and reductions in the top tax rates. The bill also includes an expansion of Education Savings Accounts for private K-12 education expenses, expands Iowa’s sales tax to apply to more online sales, and makes a number of changes to existing tax credits.

These tax cuts will have a devastating impact on the state’s ability to provide efforts to train more Iowans for the jobs of tomorrow, to increase family incomes and to help create more opportunities for our children and grandchildren. Iowa will be in a state of constant budget crisis, with decreasing resources over time.

This bill reduces general fund revenues by more than $200 million in FY19. Under this proposal, next year’s budget will need to be cut by more than $246 million to comply with the state expenditure limitation. This number includes baseline appropriations and built-in expenditures including:

- repayment of cash reserves

- school aid and transportation equity funding

- increases in medical assistance (Medicaid)

The tax plan would reduce revenues in FY20 by more than $770 million. This would likely require more than half a billion ($500 million) in further budget cuts. This doesn’t account for any increases in school aid, transportation equity, medical assistance, mental health services or public safety.

Cuts in state spending on many of these programs will result in an increase in property taxes. More school districts will be subject to the “budget guarantee” and will rely on property tax increases to balance their budgets. Public safety and mental health service shortfalls will fall back onto local governments that rely on property taxes. And Senate Republicans have already started the process to get rid of a commercial property tax backfill, shifting even more costs for local services onto property taxpayers.

Individual income tax revenues will be reduced by around $1 billion annually under the proposal. Corporate income taxes will be reduced by more than $250 million annually, which represents a more than 50 percent tax cut.

A minor portion of this revenue loss is made up by expanding the state sales tax to include digital goods and services, as well as changes to the definition of “manufacturer” to overturn an Iowa Supreme Court decision (Sherwin Williams).

However, a large portion of this potential increase in revenue is lost with other provisions expanding the agricultural sales tax exemption, a new exemption for grain bin construction, and a change to the taxation of rental or leased construction equipment. The net impact of sales tax changes in the bill is around $70 million, which is less than 6 percent of the total income tax cuts proposed.

The proposed business tax credit changes are projected to have a minor impact on overall revenues in the near term. In FY19, the changes will only reduce overall tax credit spending by $2.76 million, increasing to $7.57 million in FY20 and $15.5 million in FY21. By FY23, the tax credit changes will still be less than one-tenth of the amount of corporate income tax cuts included in the bill.

Individual income tax changes

The bill makes major changes in the determination of Iowa taxable income in an effort to streamline and simplify Iowa’s tax forms.

- The basis for determining Iowa taxable income will be calculated on federal taxable income. This will incorporate all federal tax deductions into the Iowa tax code, including the new qualified business deduction, which provides businesses that file under the individual income tax system (LLCs, S-Corp, partnerships, etc.) a major new deduction on federal income taxes. This deduction is equal to 20 percent of the qualified income from the business.

- The bill eliminates many of the Iowa specific adjustments to taxable income. A summary of those adjustments is included at the end of the document.

- The bill removes the state standard deduction. The federal standard or itemized deductions will be factored into the tax code by using federal taxable income as the base.

- The bill creates a new deduction for businesses for payments for the principal or interest of a qualified education loan incurred by the employee.

- The bill eliminates federal deductibility and lowers rates for tax year 2019.

- The bill increases the exemption for retirement and pension income from $6,000/$12,000 to $10,000/$20,000.

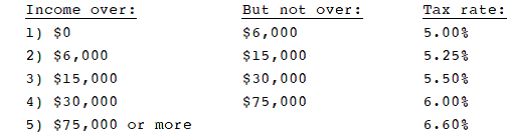

- The bill establishes new tax rates and brackets for tax year 2019:

The top rate is reduced by .1 percent over the next three years: 6.5 percent in TY 2020; 6.4 percent in TY 2021; 6.3 percent in TY 2022 and beyond. Iowa currently has nine tax brackets. The current brackets are:

| TY 2017 Tax Rate | TY 2017 Income Range |

| 0.36% | $0 – 1,573 |

| 0.72% | $1,573 – 3,146 |

| 2.43% | $3,146 – 6,292 |

| 4.50% | $6,292 – 14,157 |

| 6.12% | $14,157 – 23,595 |

| 6.48% | $23,595 – 31,460 |

| 6.80% | $31,460 – 47,190 |

| 7.92% | $47,190 – 70,785 |

| 8.98% | $70,785 + |

- Beginning in 2022, the tax rates will be indexed by inflation. Currently, tax brackets are indexed so the brackets account for income growth. Under the bill, tax rates will decrease over time. No other state in the nation indexes their tax rates in this manner. The Department of Revenue predicts this provision will lower revenues in future years by over $85 million per year.

- For tax year 2018, the bill couples Iowa’s tax code with the federal tax changes regarding the expansion of the EITC and teaching expense deductions. This is the same as what was proposed in the Governor’s tax bill.

- The bill fully couples Iowa’s tax code with federal tax changes for tax year 2019. Also, the bill will automatically couple Iowa’s tax code with federal changes in the future. Currently, Iowa only couples with federal tax changes by passing legislation to implement the changes.

- The bill does not couple Iowa’s tax code with “bonus depreciation” provisions. Iowa has routinely not coupled with this provision in the past.

- The bill also repeals the individual alternative minimum tax (AMT). This tax is paid by a small number of filers who then have the ability to receive a credit for the tax paid in later years if the AMT tax was in excess of the tax liability.

Corporate income tax

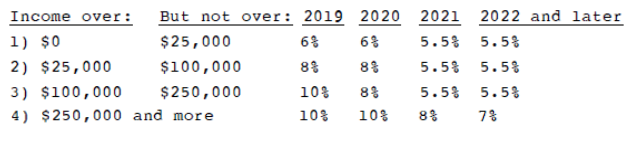

The bill makes similar adjustments to the determination of taxable income for corporations as are included for individual taxpayers. Tax rates for corporations will be reduced beginning in tax year 2019:

- The bill eliminates the existing 50 percent federal deductibility provision in Iowa’s tax code.

- The bill fully couples Iowa’s tax code with federal tax changes for tax year 2019. Also, the bill will automatically couple Iowa’s tax code with federal changes in the future. Currently, Iowa only couples with federal tax changes by passing legislation to implement the changes.

- The bill does not couple Iowa’s tax code with “bonus depreciation” provisions. Iowa has routinely not coupled with this provision in the past.

- The bill also repeals the corporate alternative minimum tax.

Tax Credits

The bill makes a large number of changes to tax credits and tax incentives:

- The bill eliminates the Taxpayer Trust Fund and the Taxpayer Trust Fund tax credit. This was created in 2013. The credit has been issued twice. Tax credits from the fund are only issued when the fund has a balance in excess of $30 million. The fund receives money when general fund revenues exceed Revenue Estimating Conference (REC) estimates, up to $60 million.

- The bill gaps the High Quality Jobs (HQJ) tax credit to no more than $80 million annually. The bill also prohibits the use of the HQJ tax credits for data centers that are not doing business in the state as of July 2018, though data centers currently in the state would be eligible to receive incentives for future expansions. The bill also prohibits the program from assisting warehouse and distribution center projects. The credit is repealed effective July 1, 2025.

- The bill increases the annual credit cap for the “angel investor” program from $2 million to $4 million. The bill provides that additional angel investor tax credits would be made available from funds set aside for Innovation Fund tax credits.

- Increase funding for the Workforce Housing tax incentive program from $20 million to $22 million. This $2 million increase is reserved for projects in small cities, which includes those not located in the 11 most populous counties.

- Lowers the annual cap for Historic Preservation tax credits from $45 million to $35 million and places a hard cap on the amount of credits per year effective FY19. The program is repealed in 2025.

- Repeals the Accelerated Career Education (260G) program in 2025. The intent of 260G is to help develop a workforce pool of individuals skilled in occupations most needed by Iowa businesses. It assists Iowa community colleges to expand current training programs or to establish new programs for these occupations. To participate in 260G, a business must be engaged in interstate or intrastate commerce for the purpose of manufacturing, processing, or assembling products, construction, conducting research and development or providing services in interstate or intrastate commerce. Retail, health and professional service businesses are not eligible.

- Extends the Targeted Jobs withholding tax credit by one year. The program was to expire after June, 30, 2018.

- Enhances the Beginning Farmer/Agricultural Assets transfer tax credit. It increases the credit from 5 percent to 7 percent of the amount paid under a lease agreement and from 15 percent to 17 percent of the amount of crops or animals sold under the agreement. The program cap is increased from $6 million to $8 million.

- The bill places a number of restrictions on the use of the Research Activities Credit (RAC).

- The bill specifies which industries are able to claim the credit. Eligible businesses are in manufacturing, life sciences, software engineering, or aviation and aerospace.

- The bill prohibits persons engaged in agricultural production, commercial and residential repair and installation including HVAC, plumbing, security and electrical systems from claiming the credit.

- The business claiming the credit must also claim and be allowed the federal RAC credit to receive the state credit.

- The bill removes the ability of a business to receive a refund or carryforward supplemental RAC credits issued under the HQJ.

- Defines “base amount” for the determination of what expenditures a business is eligible to claim under the program. This is meant to restrict the base amount to what was intended by the original legislation.

- Repeals the alternative minimum tax credit. This credit is unnecessary with the repeal of the AMT. Provides for transition period.

- Expands who is an eligible student to receive a tuition grant under the Student Tuition Organization tax credit program. The threshold for eligibility is increased from 300 percent of the federal poverty level to 400 percent of the federal poverty level. The tax credit program cap is increased by $1 million to $13 million annually for tax year 2019.

- Repeals the Tuition and Textbook tax credit beginning in tax year 2023. The tuition and textbook tax credit is available for eligible expenses related to both public and private school instruction.

- Repeals the Volunteer Firefighter and EMT tax credit beginning in tax year 2023.

- Repeals the Reserve Peace Officer and EMT tax credit beginning in tax year 2023.

- Repeals the geothermal heat pump tax credit beginning in tax year 2019.

- Repeals the ethanol promotion tax credit beginning in tax year 2019. The credit is currently set to expire in 2021.

- Repeals the solar energy system tax credit beginning in tax year 2019. The credit is not allowed for any installations after July 1, 2018.

- Repeals the Farm to Food tax credit beginning in tax year 2019.

Credit Unions/Bank tax issues

The bill attempts to “equalize” taxes paid by banks and credit unions. Currently, banks pay a franchise tax based and credit unions pay a “moneys and credits” tax. The amount paid by banks in the franchise tax is higher than what credit unions pay in the money and credits tax. This differentiated tax system was established as a reflection of the different business structures the institutions operate under, though banks argue that this is an unequal tax treatment of a competitor in the marketplace.

To address this issue, the bill includes changes favored by banks. These changes would:

- Eliminate the money and credits tax and instead assess credit unions under the franchise tax system.

- Credit unions would be assessed based on revenues minus expenses declared on their federal Form 990, which is required for non-profit entities.

- Credit unions would also owe taxes on similar items as banks as determined by the Department of Revenue.

- Banks would see a lower franchise tax rate of 2 percent on net income up to $7.5 million and 4 percent on net income above that level. Banks are currently assessed at a rate of 5 percent on net income.

Under this proposal, banks will receive a nearly 50 percent tax cut. The majority of credit unions would receive a tax cut as well, but the largest 10-20 credit unions would see a significant tax increase.

529 plans – Education Savings Account expansion

The bill includes language to incorporate the recent federal expansion of qualified expenses allowed under 529 college savings plans. The recent federal tax bill expanded the allowed expenses under the program to include private K-12 education expenses. Maximum contributions for this purpose are $10,000 annually.

The 529 saving plan was established as a means of encouraging savings for higher education expenses with contributions limited to $3,000 per year. The plans are invested in qualified securities and are designed to accumulate value while a child ages in order to pay for college. This new method will allow for the payment of expenses in the same year, essentially creating a tax deduction for private education expenses.

Sales/Use Taxes

The main provisions of this portion of the bill are included in the Governor’s proposal and are intended to provide for the collection of sales taxes owed for sales conducted over the internet to persons located in Iowa. It does this by expanding what is considered the nexus of the sale to include sales sourced to a person located in Iowa. Currently, nexus is restricted to the physical location of the seller so sellers located outside of Iowa are not obligated to collect and remit sales taxes. This issue is the subject of a case that will be coming before the U.S. Supreme Court this April.

The bill also includes digital products and information services as an item that is subject to Iowa’s sales and use tax. This extends the tax to digital downloads of movies, music, and books, as well as software. Information services includes “streaming” services such as Netflix and Hulu, genealogical research services like Ancestry.com, and others that involve the sending of digital information to the end user. The Department of Revenue has asserted that streaming television services like Netflix and Hulu are already subject to state sales tax requirements that apply to cable video services.

The bill also expands sales taxes to services that facilitate the rental or use of lodging and automobiles. This would require companies like Uber/Lyft, AirBnB, and others that assist in these transactions to collect and remit sales taxes. The bill also makes these companies jointly liable for the taxes owed on services they assist in accommodating. This means booking services like Travelocity are liable for taxes owed on hotel rooms reserved using their platform in the event the hotel does not remit the taxes owed to the state.

New items in this bill that are not included in the Governor’s proposal include an expansion of the existing sales tax exemption for goods purchased for use primarily in agricultural production. The bill consolidates current agricultural sales tax provisions and creates a general sales tax exemption for goods primarily used in commercial agricultural production. The bill also provides a new sales tax exemption for the sales price of a grain bin or materials used to construct a grain bin.

Another new provision in this bill would restrict who may qualify as a manufacturer to standards that were in force prior to an Iowa Supreme Court decision in a case involving Sherwin Williams. This definition of manufacturer would eliminate the ability of a number of businesses to claim the manufacturer exemption from sales tax owed on purchases of equipment and scale back the use of Iowa’s sales tax exemption on manufacturing equipment.

Another new provision would make changes to when a sale of construction equipment is subject to state sales tax. The bill would exempt sales of construction equipment that was purchased for lease or rental from being subject to the sales tax when that equipment is sold by the entity that rented or leased the equipment. Generally, when equipment is sold for lease or rental it is not subject to the sales/use tax, but the sale is subject to the tax when the equipment is sold by the lease or rental company.

Changes to Individual Income tax adjustments

SF 2383 eliminates or phases out these deductions related to the calculation of Iowa taxable income:

- Employment of disabled individuals and former prisoners

- Organ donation

- AmeriCorps service income

- The cost of purchasing health insurance for spouse or dependents (only impacts Iowans taking the federal standard deduction)

- Net capital gains deduction, including the 50 percent deduction for capital gains associated with a qualified Employee Stock Ownership Program

- Restitution/compensation for property taken through involuntary condemnation/eminent domain

- Income earned by non-residents who conduct emergency response work for utilities in the event of a disaster

- Tax expenses for a fiduciary in the execution of an estate

- Compensation received as restitution for Agent Orange exposure, those kept in Asian-American internment camps during World War II, and those victimized by Nazis

- Income earned during active duty performed in Desert Storm, Bosnia-Herzegovina peace keeping, and second Iraq war operations

SF2383 appears to remove income from these provisions from calculation as Iowa taxable income:

- Certain intangible drilling and development costs described in IRC §57(a)(2).

- The percentage depletion amount with respect to certain oil, gas, or geothermal wells described in IRC §57(a)(1).75

- The depreciation taken on a speculative shell building, defined in Iowa Code section 1(27), that is owned by a for-profit entity receiving the proper tax exemption, unless the taxpayer is not using the building as a speculative shell building. For state income tax purposes, depreciation is computed and subtracted from federal adjusted gross income as if the building was classified as 15-year property.

An amendment adopted on the floor made a number of changes to the bill, including:

- removing the expansion of the sales tax to digital goods and services

- restoring $5 million of tax credits under the Historic Preservation incentive program so the program will be reduced to $40 million from the current level of $45 million

- increases the expansion of the retirement income exclusion; the retirement income exemption will eventually be increased to $12,000/$24,000 from the current $6,000/$12,000 level

[Committee: 2/22: 9-6, party line; Floor: 2/28: 29-21, party line (No: D. Johnson, Democrats)]